About

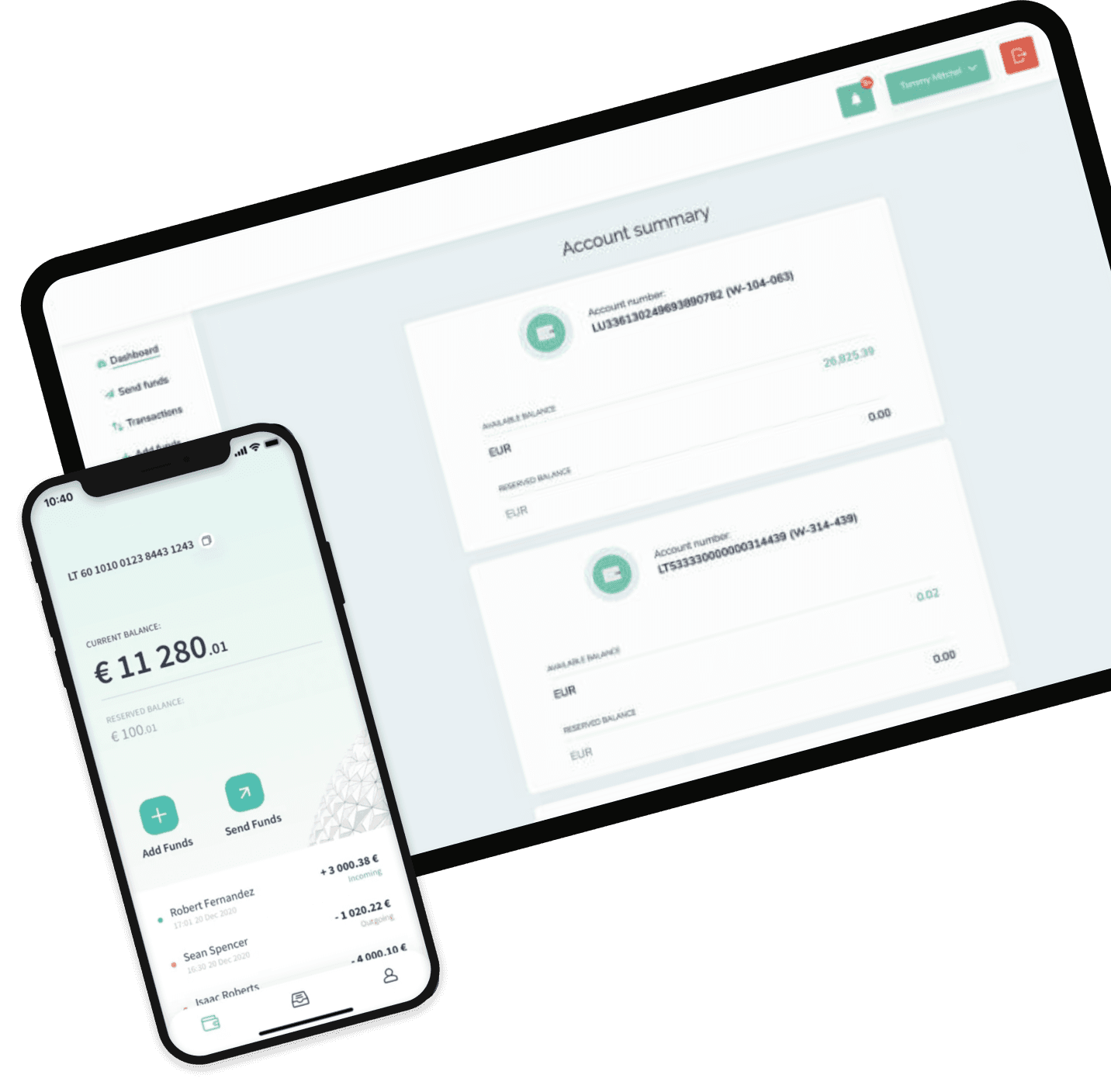

Neobank application that provides users with a range of financial services, including banking, budgeting, and investment management. It operates exclusively online, enabling users to access their accounts from anywhere and at any time. Great advantage is seamless user experience, with easy-to-use interfaces and personalized features.

The bank provides:

Very fast flow for registration european IBANs

The software development team has implemented a very fast registration flow for European IBANs, allowing customers to easily sign up and start using the bank's services without any unnecessary delays.

Managing virtual and physical cards in the application

After adding your card to the app, the user can start to make transactions instantly. Neobank allows to take complete charge of the funds by regulating security settings, spending boundaries, and other options.

Managing subscriptions in the application

Users can also manage their subscriptions through the application, giving them greater control over their finances and allowing them to easily track and cancel recurring payments.

Customisable business fees

The team has created a customisable fee structure for businesses, giving them the flexibility to tailor their pricing to suit their specific needs and requirements.

Swift / sepa transactions

The bank's application supports both Swift and Sepa transactions, enabling customers to transfer money quickly and securely across a wide range of countries and currencies.

Modern ux / ui for both mobile and web client

The point breaker was to focus on a modern and intuitive user experience for both the mobile and web versions of the application, ensuring that users can easily navigate and use the platform.

Client’s location

Vilnius, Lithuania

Timeline

10 months, in 2020-2021 years

Team

1 mobile and frontend tech lead, 2 mobile developers, 2 backend developers

customers say

Review on ClutchInvolvement and task challenges

Task 1

Although we always work on the specific technical architecture creation, on neobanking projects we give great focus to UI UX from the business side. It was important to make a seamless and really simple flow for users.

Task 2

After setuping the business priorities, we focused on right team building that could take all the work done with even higher expectations. Main part of the job was to lead the team of mobile and web developers.

Task 3

As we dealt with user registration flow for business and individual clients, we paid great attention to subscriptions management and payment cards management functions.

Task 4

We worked on a customizable fee structure which could work easily for different categories of clients and would be automated on our side, without too much involvement of support managers.

Task 5

The final part was to work on integration with different government services, banks and KYC.

Task 6

And of course, during all the process, we adhere to the regulations and compliance of those markets where the application planned to enter.

USED Technologies:

Implemented Integrations:

Project in mind

You can also write to us directly to our mail with project thoughts, especially, if you want to proceed on a free tech consulting call.

Email for partners

[email protected]Tech requests directly to our CTO

[email protected]we are featured

Related case

view all

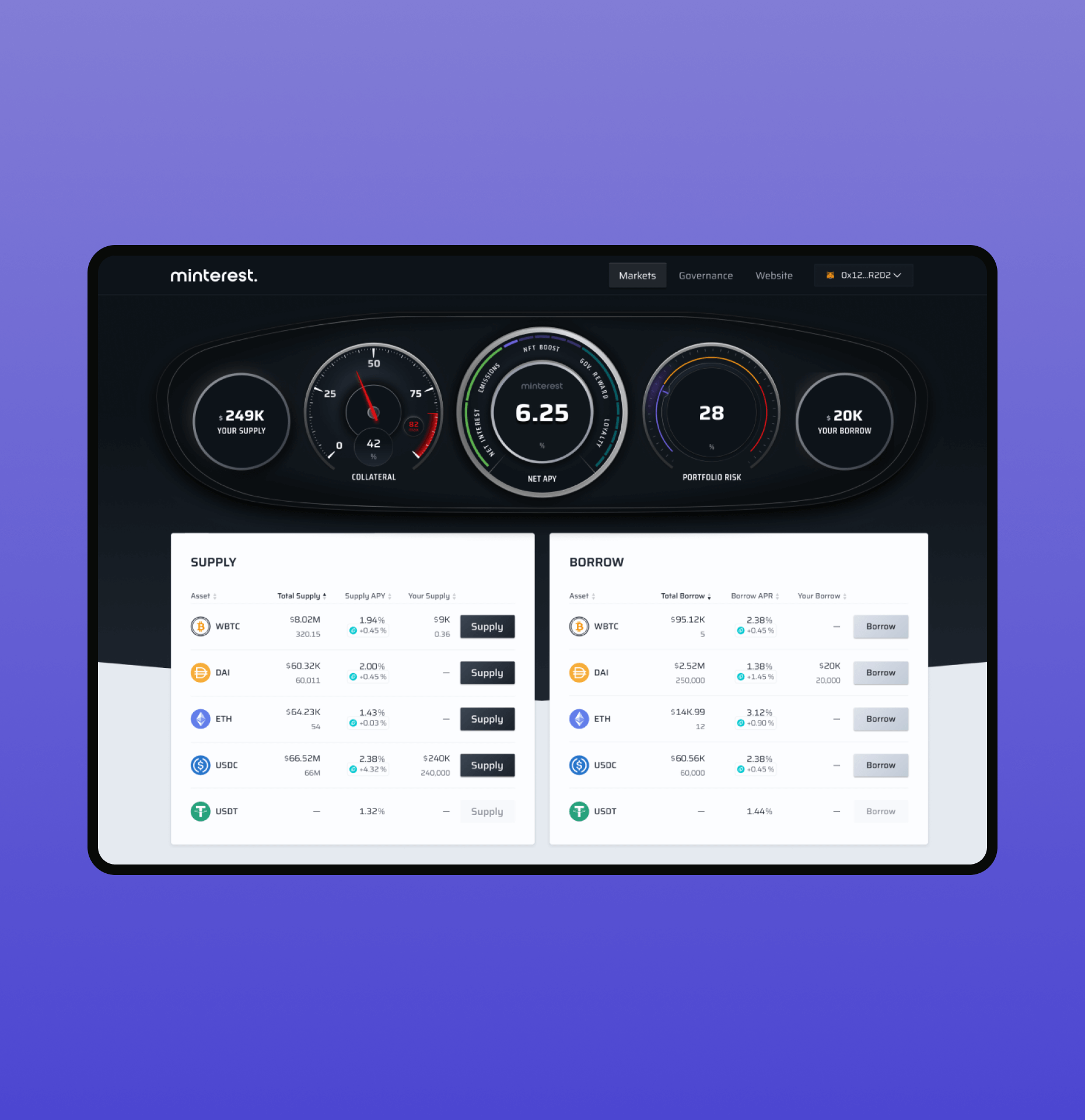

Decentralized lending protocol

The lending protocol allows users to supply or deposit tokens to its token markets in order to receive interest in return.